Gold

and Silver Charts

See my charts on gold and silver here: taluis.wordpress.com/charts

Enormous volume in Silver for the months of February-April, 2013. From:

NetDania.

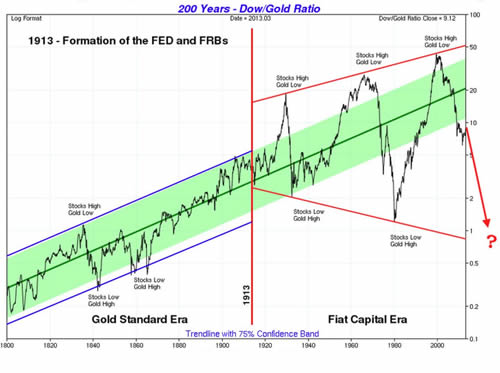

Stock market decline together with a gold parabolic cliimb in the 2014-2015

timeframe. The following chart is taken from this article: Major

Top in Stocks and Major Bottom in Gold.

.

Gold/Silver mania phase possible in the 2015-2016 time period:

Very long term silver chart below (Exit

From Massive Silver Base Projects Staggering 1,020% Move). The latest

resistance tested, with a slight false break, was in April of 2011 at

the monthly closing level of $48. The previous all-time monthly closing

high was on Jan 31st, 1980 at $38.53 (although the intraday high was

slightly above $50). This price pattern indicates that the silver price

should move significantly higher on the next sustained break above the

$38.50 to $40 zone....The minimum topside target for silver is around

$200 which is the top of the major price channel.

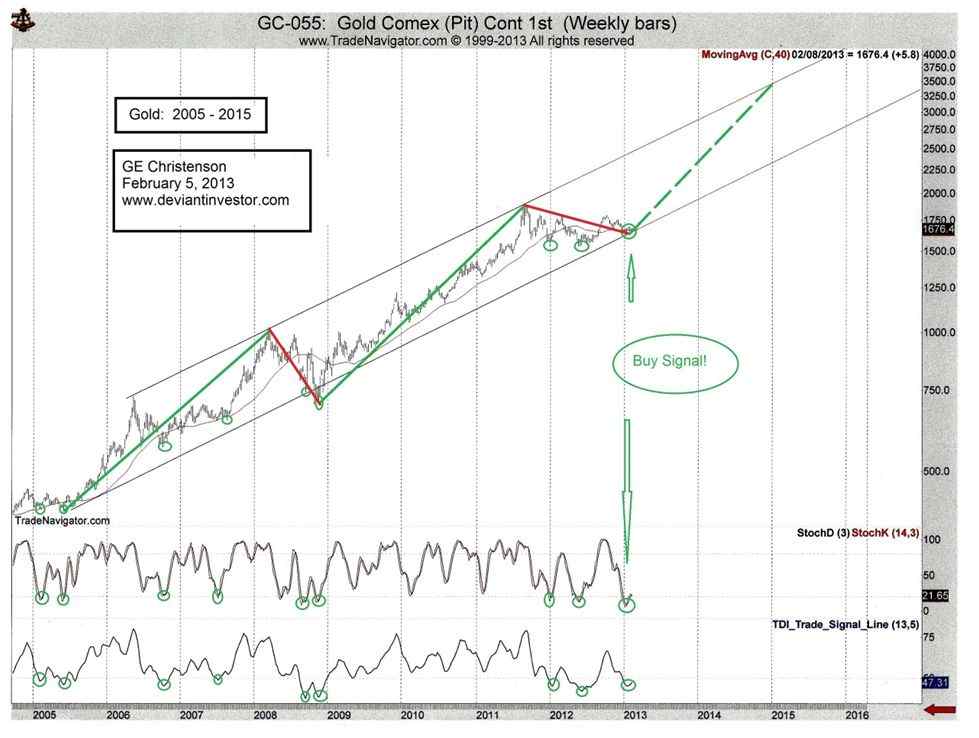

Gold

– Weekly Buy Signal: The weekly stochastic and TDI indicators

produced a “buy-signal” in the gold market (and various ETFs

for gold) in January 2013.

Gold

Market Update: The 7-year chart for gold shown below is very

interesting and useful as it reveals that gold can drop back down as

far as its lower supporting trendline and crucial strong support at

and above $1500, without it even putting a dent in its long-term bullmarket.

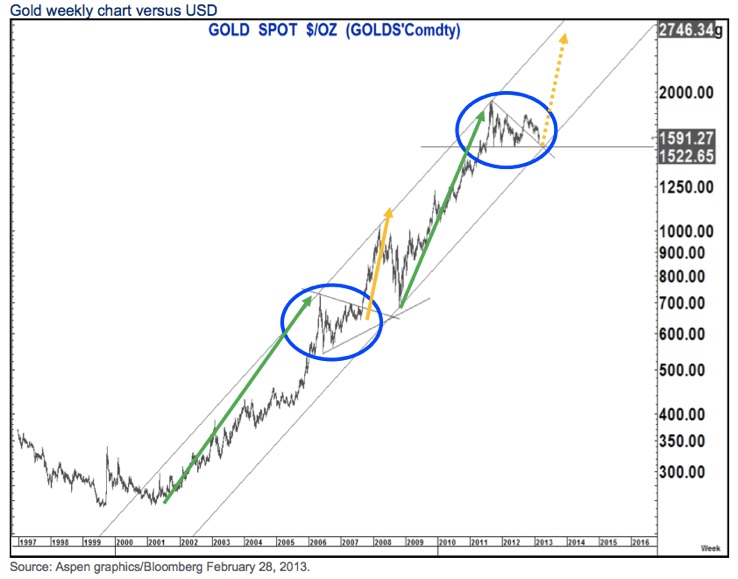

Special

Friday Gold ‘Chart Mania’: We continue to believe

that the present pattern in gold over the past 17 months remains similar

to that seen during the 16 month consolidation in 2006-2007 before it

moved higher again. Very strong support continues to exist in the $1,520-$1,530

area and we still believe this to be a platform for the next leg higher....it

is a break of the $1,790-1,800 area on a weekly close basis that would

signal a topside breakout. A move towards $2,055-2,060 would be the

target on that break.

What

OMF Means for GOLD: A lift in gold with a correcting equity

market should not be unexpected.

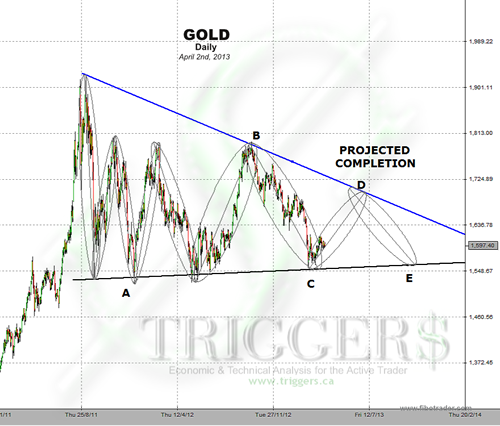

We do a lot of work with Fibonacci Ellipses and they have proven extremely

accurate within this central bank controlled environment which we are

presently witnessing. Our Fibonacci Spirals (below) has confirmed the

consolidation pattern with a high probability.

.

|