History

on Precious Metals

"Money is not wealth. It is merely a claim on wealth."

--Unknown

"During times of universal deceit, telling the truth becomes

a revolutionary act." --Unknown (misattributed to George Orwell)

"A government big enough to give you everything you need, is

a government big enough to take away everything that you have."

--Thomas Jefferson

"The trouble with Socialism is that eventually you run out

of other people's money" --Margaret Thatcher (a paraphrase).

Her actual statement was, "Socialist governments traditionally

do make a financial mess. They always run out of other people's money.

It's quite a characteristic of them. They then start to nationalise

everything, and people just do not like more and more nationalisation,

and they're now trying to control everything by other means. They're

progressively reducing the choise available to ordinary people."

(From an interview with journalist Llew Gardner for Thames Television's

This Week program on 5 February 1976.)

“Whenever destroyers appear among men, they start by destroying

money, for money is men's protection and the base of a moral existence.

Destroyers seize gold and leave to its owners a counterfeit pile of

paper. Paper is a mortgage on wealth that does not exist, backed by

a gun aimed at those who are expected to produce it. This kills all

objective standards and delivers men into the arbitrary setter of values.

Gold was an objective value, an equivalent of wealth produced. Paper

is a check drawn by legal looters upon an account which is not theirs:

Watch for the day when it bounces, marked “account overdrawn.”

--Ayn Rand.

History log

- <<John

Exter>>

- John

Exter (1910-2006): The Central Banker Who Made A Fortune In Gold.

Posted 1/23/2013. In a debate with Paul Samuelson in 1962, it dawned

on him how he could make a fortune in gold. "With a huge fortune

made on the gold market by using his own expertise on the foresight

of irresponsible central banking and its inevitable consequences,

Exter took an early retirement in 1972 and went into private consultancy

work."

- A

Brief 2000-Year History Of Silver Prices. Posted 12/26/2012. It

is worth asking whether the price of silver stacks up as fair. For

more than 2,000 years, somewhere between 1/7th (4.2 grams) and 1/15th

(2.1 grams) of an ounce of silver would buy you a day’s labor;

in today’s terms, that would suggest that silver should trade

for $264, if U.S. wages should be seen as the global standard (i.e.

$58/day minimum wage). By way of comparison, minimum wages in China’s

Guangdong province (an area with extensive manufacturing activity)

would work out to about $6/day on average or about 5.6 g of silver

– about half the wages in 4th century Greece, so it really is

a case of what you consider to be the representative global wage.

If we take the Chinese wage, it takes about a week to accumulate 1

ounce of silver.

- (YouTube)

Extraordinary Popular Delusions And The Madness Of Markets. Posted

10/20/2012. Presentation of economic bubbles in history. Four phases:

(1) Stealth phase, (2) Awareness phase, (3) Mania phase, and (4) Blow-off

phase.

- Private

debt caused the current Great Depression, not public debt. Posted

5/11/2012. Private (corporate and consumer) debt in 1929 was 240%

of GDP versus 310% in 2008. [I NEED TO VERIFY THIS DEBT RATIO,

otherwise this author's whole argument falls apart.] (It has currently

dropped to 260% of GDP.) Government debt in 1929 was a paltry 40%

of GDP. (It is currently over 100% of GDP.) In 1945, when America

was financing its participation in World War II, government debt exploded

to 120% of GDP. It is interesting to note that there was also a Real

Estate bubble in the 1920s, from 1921 to 1926. See The

Forgotten Real Estate Boom of the 1920s. The author argues

that the debt that must be destroyed is, primarily, Private Debt--private

enterprise debt and private consumer debt. Private sector debt

destruction (or deleveraging) is likely to continue for a decade or

more, given the level of accumulated private debt.

- 8

Reasons Why The Great Depression Is The Best Case Scenario. Posted

9/21/2011. Back in the Great Depression years, Americans could feed

themselves with farming, had strong family and community support systems,

had a manufacturing (versus consumer/debt-based economy), were more

physically active and fit (versus obese and inactive).

History of the Federal Reserve (the Fed)

Historical charts

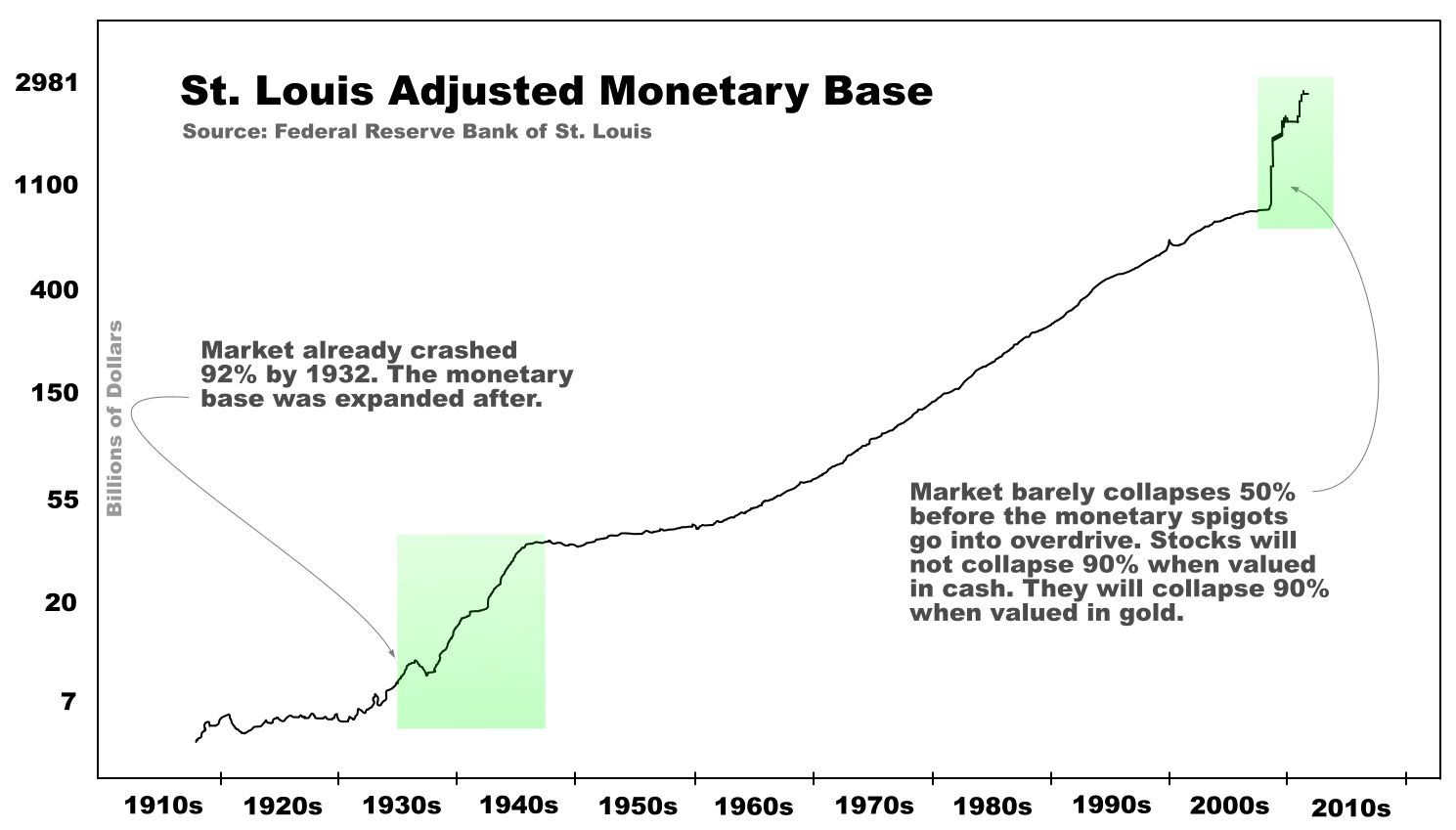

From: Why

The Debt Exploded. The chart below is an exponential growth curve

in U.S. government debt. Of course, the numbers on the national debt

are grossly understated as it doesn't account for the tens of trillions

of Dollars of unfunded and unpayable obligations tied to Social Security,

Medicare, and so forth. In other words, the debt situation is even worse

than this chart portrays.

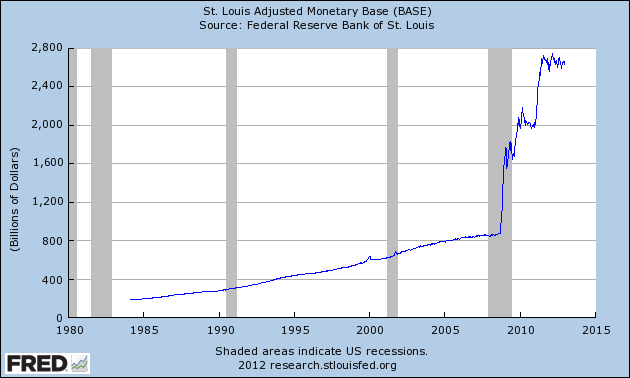

St. Louis Adjusted Monetary Base

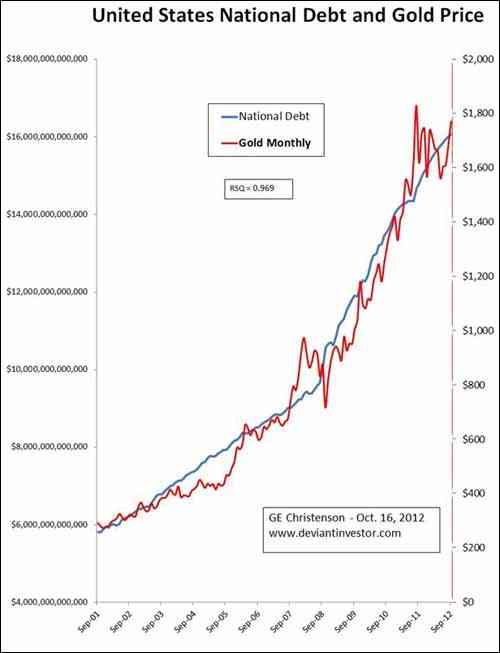

United

States National Debt and Gold Price. The exponential

growth rate for the national debt averaged over this period is 9.7%

compounded annually, while the rate averaged over the last five years

is 12.3%. The exponential growth rate for gold is a bit larger –

about 18% per year compounded annually. I attribute this to the realization

that gold is a competing currency, mining supply is growing little,

most governments are aggressively “printing money,” investors

are increasingly interested in gold, and central banks are buying, not

selling gold.

Analysis of Historical Charts

From: Gold

& The Frightening Picture Of Our Financial Abyss. Posted 1/3/2013.

The author ompares the Adjusted Monetary Base (from Federal Reserve

Bank of St. Louis) to the price of Gold since 1984. Shows the undervaluation

of gold relative to the monetary base. It is clear that gold is nowhere

near the overvaluation of the 1980s. All the following data is courtesy

of the St.

Louis FRB.

St. Louis Adjusted Monetary Base

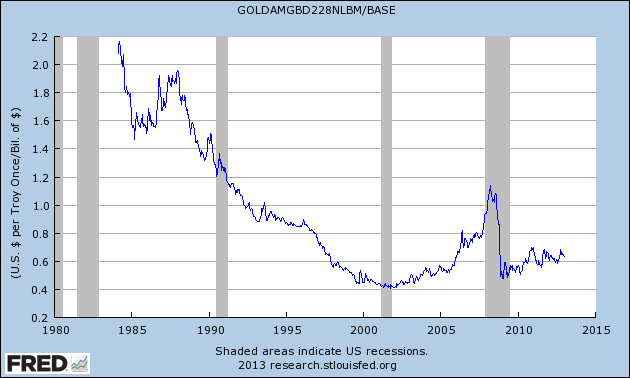

The price of Gold divided by the St. Louis Adjusted Monetary Base.

Notice how undervalued Gold is today relative to the 1980s. "Given

that there is no end in sight for increases in the monetary base, the

financial potential energy contained in the current price of gold is

extreme."

The following chart shows the nominal (not inflation-adjusted)

silver price in red, while the real (inflation-adjusted) silver price

is superimposed in blue. This uses the CPI to recast silver prices in

constant November 2012 dollars, the most recent monthly CPI data currently

available. Reference: Real

Silver Highs 4. Posted 1/11/2013.

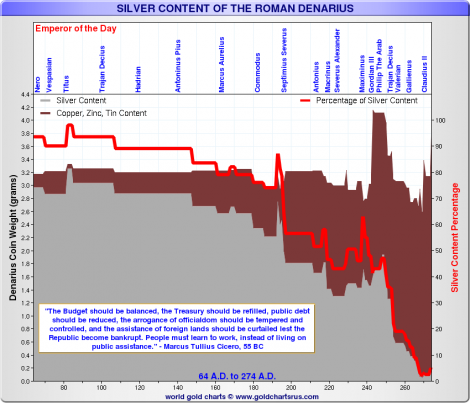

How the silver content of a Roman denarius declined over time.