iTulip.com

notes

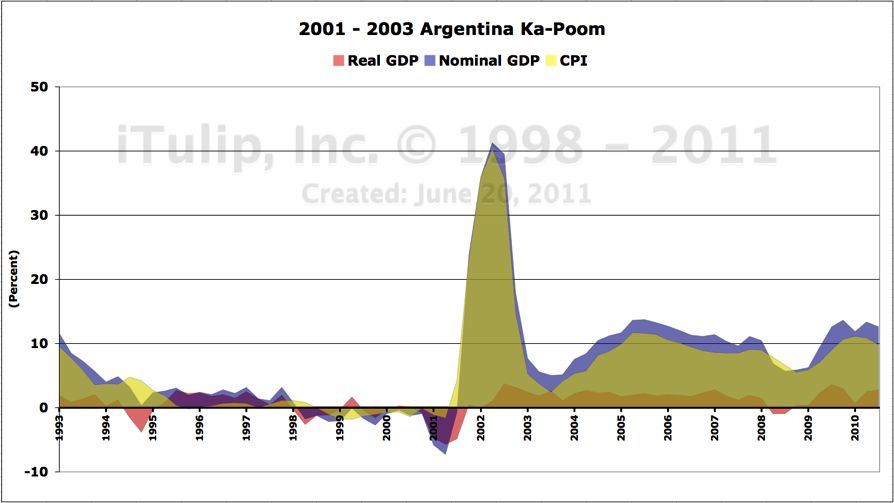

Basic theory: An epochal shift in the gold market started in 2001 and

has continued, with periods of volatility, at more or less the same

trend rate ever since. My theory since 2001 is that the rising gold

price trend traces the gradual dissolution of the US$ Treasury system

punctuated by crisis and temporary resolution. It will eventually end

with a Sudden Stop crisis that I have since 1999 called Ka-Poom Theory,

possibly mitigated by a re-opening of the gold window. The Argentina

peso bond market crisis of 2001 and 2002 confirms the Ka-Poom Theory

which is comprised of two phases, a deflationary phase driven by capital

flight and an inflationary phase that results from a currency depreciation.

See Argentina's Ka-Poom graph below.

See also, (VIDEO)

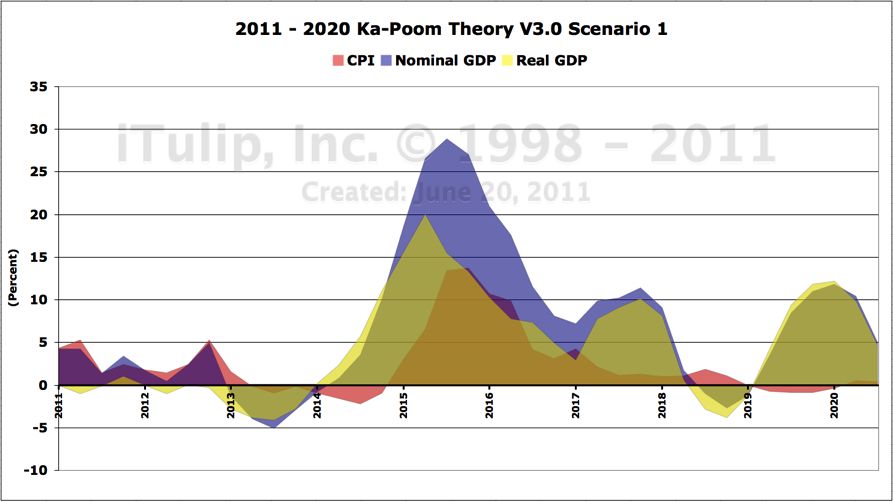

Argentina's Economic Collapse. A U.S. version of the Ka-Poom

theory, still a work in progress, is mapped below.

Notes from: The

Next Ten Years--Part II. Over the coming two years (2011-2013),

expect to see the economy continue to grow moderately in nominally between

2% and 3%, while it continues to shrink in real terms. However, at some

point interest rates will begin to rise in response to inflation, even

as the output gap continues to put a deflationary bias on consumer prices

and wages. That will tend to open the gap even wider, as borrowing costs

rise.

The recession of 2012-2013 will be created by the withdrawal of fiscal

stimulus by the majority Republican 111th Congress. Under conditions

of debt deflation, if stimulus is withdrawn before an output gap was

closed, recession recurs. This second recession will open the output

gap to 6% of GDP. The first recession was from 2007 to 2009. That recession

opened the output gap to 4% of GDP. The monetary stimulus of dollar

devaluation against oil plus the fiscal stimulus of the Bush and Obama

administrations, together these measures closed the output gap from

4% to 2% of GDP between 2009 and 2011.

A recession event in 2012-2013 suggests only one policy option -- monetary

inflation -- but several scenarios for achieving it with sufficient

political cover to prevent foreign creditors from bolting. The output

gap is likely to grow to 8% by 2014. At that point, inflation becomes

the only option. We will continue to use public funds to grow the money

supply as private sector borrowing remains too weak to do so and monetary

policy is now ineffectual. For the next several years, the US will continue

to claw its way through the output gap by moving private debt to public

account as Japan has since 1992 until either the US runs out of public

credit or an external global geopolitical event occurs that has the

effect of producing a large spike of inflation.

Three factors will influence our investment decisions over the next

ten years.

- China's finance and export based state capitalist system will enter

a severe crisis in 2012-2013 as its property bubble collapses.

- The Euro will not end. The eurozone will shrink as weaker debtor

economies such as Greece are jettisoned and creditors consolidate

economic and political power.

- The world will have three reserve currencies by the end of the decade:

the dollar, the euro, and the yuan representing American, European,

and Asian trade blocks.

2011 to 2020 Uncertainty Era Asset Allocation Rulebook

Rule #1: As long as the US economy remains in an output gap trap,

the fiscal position will worsen. When the housing bubble collapsed the

US fell into the output gap trap that consigns the US to ever-growing

fiscal deficits, at least until the US runs out of public credit. If

the US attempts the Japanese method of managing the output gap via fiscal

stimulus at the same rate starting in 2000, the US public debt will

reach 140% by 2015.

Rule #2: As long as the US fiscal position worsens, the dollar

will weaken. The US cannot grow its public debt to 195% or 140% of GDP,

and likely not even 100%, because of the US economy's dependence on

imported capital and its gross external debt position. Invariably, for

a net debtor, a fiscal deficit puts pressure on the currency.

Rule #3: Periods of high energy costs are periods of poor economic

growth and stock market performance. The time to be in the stock market

is when inflation is on a falling trend, as it was from 1980 to the

year 2000. The worst time to be in stocks is at the beginning of a period

of rising inflation. The Argentina peso bond market crisis of 2001 and

2002 confirms the Ka-Poom Theory which is comprised of two phases, a

deflationary phase driven by capital flight and an inflationary phase

that results from a currency depreciation. See here.

A new administration will some day place the blame for the crisis on

the previous administration and take no responsibility for the hardship

that their decisions are about to visit upon us.

Rule #4: If the US fails to exit its output gap before the next

recession, the US will experience a bond and currency crisis several

years thereafter, as soon as after the 2012 presidential election or

as late as the 2016 presidential election. See here

for a US version of the event, still a work in progress.

Summary

The 1980 to 2007 credit bubble was an existential economic error akin

to the 1920 to 1929 credit bubble. The credit bubble entered its first

crisis in 2000. The Greenspan housing bubble was a credit-financed New

Deal (akin to the 1930s) that rescued the economy in 2002. The next

stock market correction will be driven by the pricing-in of the mid-gap

recession (which may have begun in August, 2011). The 2008 to 2009 financial

crisis and economic recession was the first phase of the process of

debt deflation following the multi-decade credit bubble.

We are out of private credit needed to finance a next bubble. Within

a few years we will be out of public credit needed to move private debt

to public account to manage a persistent output gap, debt deflation,

and Peak Cheap Oil all at once. Europe's, China's, and US sovereign

crises will occur in rapid series over a period of months perhaps starting

as soon as 2H 2012. Sovereign credit games in Europe, China, and the

US will end in a cascade of sovereign debt defaults and a currency markets

crisis that will eventually be resolved through the development of three

currency blocks, American, European, and Asian by 2020.

Social relations among competing interest groups will escalate. Governments

will respond to escalating domestic unrest with increasingly repressive

surveillance and control. The primary investment challenge of the next

ten years is economic and political uncertainty.

We will experience the greatest economic and social uncertainty

in 100 years over the next ten.

Notes from: Illusion

of Recovery; Global Panic into Gold--Part II.

The key thesis of Ka-Poom Theory is that the US will experience a debt

and currency crisis if US creditor countries run into economic and political

difficulties at home that lead them to calculate that they are better

off focusing on domestic policy matters rather than applying resources

to support the US in a bid to maintain the US as a viable export market.

Two ways The Deal (i.e. the arrangement of foreign investment in the

US in exchange for US demand for exports) is off. One, the US cannot

provide sufficient demand for Asian and European exports. Two, the US

in its effort to reflate debt rather than take politically painful steps

to write it off depreciates the dollar too far, too fast, exporting

inflation abroad. As the US demand engine sputters and inflation rises

world wide, foreign investment in the US dries up. This appears to have

started in Q1 2010.

The rate of foreign purchases of all US securities, of which Treasury

bonds are by far the largest part, began to decline in early 2010. Think

of it as the slow stop before the sudden stop. Net purchases turned

negative in June 2011, the last month reported. I do not think the correction

we saw in the stock market starting in July was coincidental. If the

trend since early 2010 continued in July and August and then into September,

and is joined by sales of US stocks, we may see a good old fashioned

autumn stock market crash.

The US$ Treasury based global monetary system began to break down in

2001. Since then, the process of breakdown has gone through several

stages. When central banks became net buyers in Q1 2009 the breakdown

entered a new stage. The reason for the price spike this summer could

be as simple as rumors of new central bank purchases on the heels of

purchases by the central banks of South Korea and Thailand. More likely

a new major buyer has emerged, one that reveals a significant political

shift in the system. The list of possible suspects is large and includes

Japan at the top of the list. I expect many similar parabolic rises

and corrections before the US$ Treasury epoch ends, as speculation about

shifting alliances among players drive gold prices.

- The parabolic rise of the gold/10-Year Treasury bond yield ratio

this summer backs up the notion that a new stage of the breakdown

has started.

- The tumultuous recent history of currencies priced in gold is driving

more and more governments to switch sides, reduce US$ Treasury bond

reserve holdings and increase gold holdings.

- Gold purchases and sales by government and international banking

institutions since Q1 2000 entered a new phase in Q1 2009. Rumors

of new entrants and shifting alliances will drive gold price volatility

for the duration of the epoch, and generally up.

The trend in the decline in the exchange rate value of currencies priced

in gold is ten years old, and the severe decline is five years old.

The trend of government net gold buying is two years old. The trend

in the decline in US Treasury bond purchases is 18 months old.